Building Provider Networks: Benefits of Developing High-Quality, Robust Networks for the Medicare Advantage Market

Charlie Bruetman, MD

J2 Health Advisor Charlie Bruetman, MD, is the Founder and President of Retium Health, which provides advisory services to healthcare organizations. Prior to Retium Health, Dr. Bruetman was a Senior Vice President at The Lewin Group, a leading healthcare research consulting firm, where he led the development of network adequacy criteria for CMS.

Provider networks are a vital function of health plans. Networks play a crucial role in care delivery; effectively building and managing provider networks is essential for a plan’s success. I have found this to be specifically true in Medicare Advantage (MA), where failure to build regulatory-compliant, high-performing networks can have huge downstream implications including health outcomes and economic consequences that can detract from a health plan’s success.

Over the years, as a consultant to many healthcare organizations, including collaborating with the Center for Medicare and Medicaid (CMS) on the development, implementation, and continuous improvement of the new provider network standards, I have learned that there are ways MA plans can avoid some of the traditional network building pitfalls.

By developing a MA network strategy around regulatory compliance and performance quality, Medicare Advantage Organizations (MAOs) may circumvent challenges including, low star ratings, inability to enter/expand into new markets, and suppression from MA plan finder among others. Therefore, it is key for MAOs to not only have the right number of providers in the right locations, but also select the right providers to ensure high-quality of care to their beneficiaries.

Regulatory Compliance: With a streamlined review process comes more scrutiny and associated risks.

Participating in the MA program is very attractive to health plans, with an average gross margin significantly higher than in other markets1. However, the MA program comes with more regulatory requirements than other types of plans, such as employer plans. As part of the team that developed the most recent network standards (implemented in 2010), I can say that these requirements were developed to improve access for MA enrollees and create an objective, streamlined review process. The changes also led to significantly more risks and associated economic consequences for plans that did not adequately manage their provider networks. Consequently, this regulatory scrutiny means that plans must make sure they construct their networks carefully to ensure long-term success.

Working with CMS with the revamping of the network adequacy criteria and review process for the MA program, my team and I identified key areas for improvement and established new network standards2. Existing standards indicated that MA coordinated care plans must “maintain and monitor a network of appropriate providers that is supported by written agreements and is sufficient to provide adequate access to covered services to meet the needs of the population served” (42CFR§422.112 (a)(1)(a)). However, CMS had faced significant challenges with the approval or rejection of plan network submissions due to a lack of objective criteria across regions used to evaluate MAO networks and their health service delivery (HSD) tables. The vague concept of “adequate access” caused concern for both CMS and MAOs since it could be interpreted differently by each party and even within CMS regions evaluating HSD tables.

My team and I worked closely with CMS to establish clear, objective network adequacy standards and adopt new criteria, including using time and distance standards for different specialties and facilities across county designations. With new standards now in place, including the availability of exception requests when criteria could not be met, MAOs had a clear roadmap to developing and submitting compliant networks necessary to enter or expand into new markets. Additionally, with the implementation of the triennial network adequacy reviews, CMS ensured that MAO networks were updated and compliant on an ongoing basis.

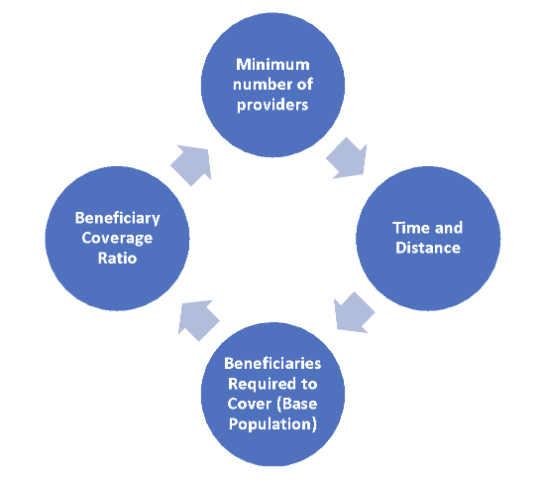

For MA, the current provider network requirements include four key elements.

Currently, plans must demonstrate that they meet CMS’s network standards to receive approval to offer services in a market (or expand).

In addition to market entry and expansion concerns, failure to meet CMS network requirements may have significant consequences. Plans could be suppressed from Medicare’s Plan Finder, preventing future potential enrollees from exploring their plans and other penalties.

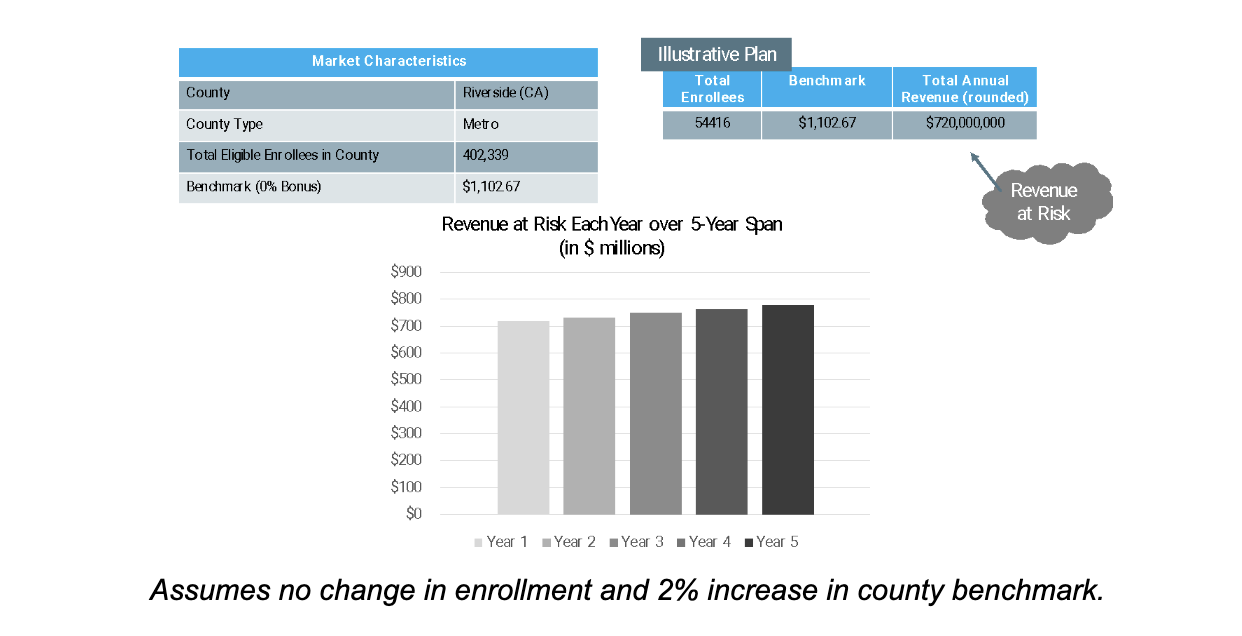

To better understand how non-compliance may affect a MAO, we modeled the potential economic implications for an illustrative plan. This hypothetical plan is based on the average enrollment of the three major plans in the Riverside, CA market using 2023 benchmarks (0% bonus). The model shows that the risk of non-compliance is substantial. Not being able to participate in this market could lead to losing revenues of over $700M/year as shown in the exhibit below.

While many plans can find achieving regulatory compliance burdensome, the potential economic downside to failing to achieve compliance puts pressure on MAOs to prioritize appropriate access to care.

Performance Matters: Higher quality leads to improved plan performance

Beyond compliance considerations, MAOs must build a network that focuses on keeping quality high and costs low, resulting in better beneficiary health and wider health plan margins. These efforts include adding high-quality providers based on performance measures and reducing the number of providers with a historical record of providing unnecessary, low-value care, which can help MAOs increase the quality of care for their beneficiaries and increase their star rating.

Star Rating:

CMS developed the Star Rating program to allow Medicare beneficiaries to compare MA options in a market. The program measures the quality of health services received by beneficiaries enrolled in MAOs, which are assigned a star rating (5-star scale) based on their performance across a series of quality measures (e.g., annual flu shot, colorectal cancer screening, diabetes care eye exam). This program, therefore, seeks to encourage improvement in the quality of care and help consumers identify high-performing plans.

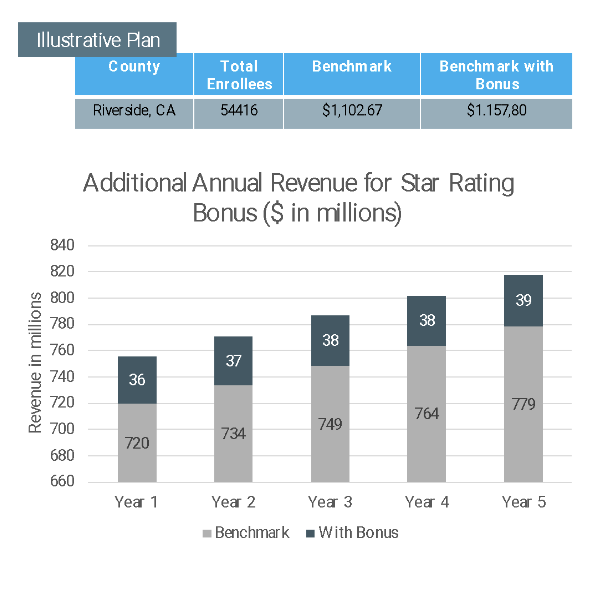

Star ratings not only serve as a guide for beneficiaries choosing an MA plan but also factor into the final plan payment with higher-rated plans receiving a bonus payment above the county benchmark. In addition, star ratings overlap with multiple other quality initiatives that impact provider networks (e.g., HEDIS, QIPS, CAHPs, Physician Compare).

When considering the economic benefits of higher star ratings, applying the same “illustrative plan” in Riverside, CA, previously modeled, the additional revenue (star rating bonus) may represent over $36M per year ($188M over 5-year span) for the MAO.

From a growth perspective, a McKinsey study identified that a plan with a four-star rating or higher remains financially stable. Furthermore, for 56% of enrollees, star ratings are a top priority purchasing factor3.

Providers are critical in determining a plan’s star rating since they are ultimately responsible for ensuring high-quality, timely care. Selecting high-quality providers in your networks and working closely with them enhances a plan’s opportunity to receive a higher star rating.

Decrease utilization of low-value care:

While healthcare prices are the main issue driving high healthcare costs in the US, overtreatment plays a significant role and is estimated to cost between $158-226B4. Recognizing instances of low-value care and identifying providers responsible for such overuse can be complex. However, several resources, including CMS’s quality programs and the Choosing Wisely initiative, among others, offer plans assistance in evaluating provider quality. Prioritizing these identified high-quality providers can help reduce low-value care, decrease utilization, and moderate unnecessary spending.

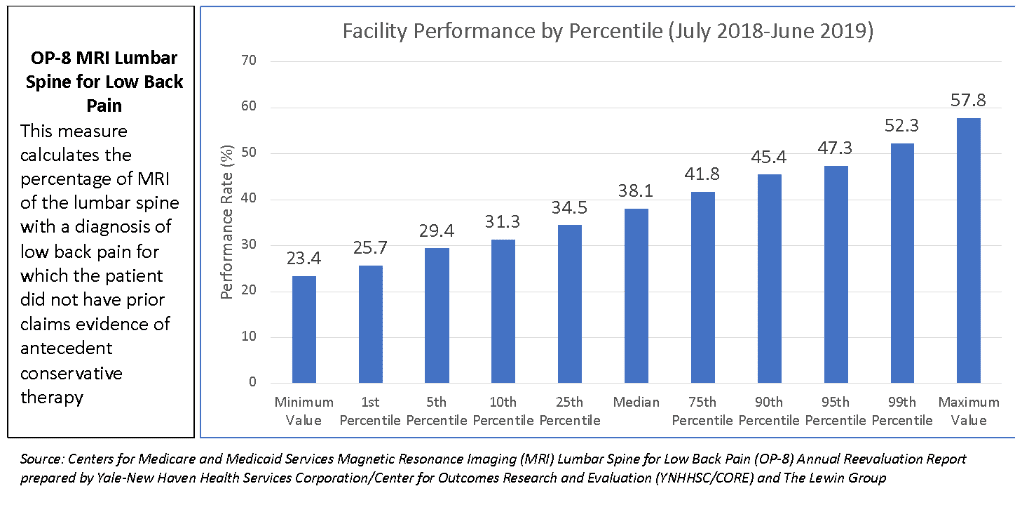

In addition to reducing costs, identifying low-value care can reduce harmful practices to beneficiaries. An example of potentially low value care is using MRI for low back pain. CMS developed an efficiency measure for the use of MRI lumbar spine for low back pain (OP-8). This imaging modality had also been identified by Choosing

Wisely as an area of concern. MRI lumbar spine for low back pain is a commonly used imaging test that is not always necessary and leads to increased costs of care and to possible unnecessary surgeries. These potentially unintended consequences affect patient’s quality of care and create additional utilization and costs to health plans. CMS’s public reporting program identifies providers with higher scores that may be overusing imaging. MAOs should consider provider performance across clinical quality/efficiency measures to ensure beneficiaries receive the right care in a timely manner.

In conclusion, the quality of a provider network directly influences the performance of a MAO. A well-managed network promotes positive health outcomes, member satisfaction, and financial stability. To ensure a plan’s success in the MA market, MAOs must prioritize regulatory compliance issues along with the development and maintenance of high-quality provider networks that address the needs of their members while effectively managing costs.

References

- Jackson G, Fehr R, Cox C, Neuman T. Kaiser Family Foundation, 2019 Financial Performance of Medicare Advantage, Individual and Group Health Insurance Markets. August 5, 2019

- The Lewin Group, RTOP No CMS-08-017/VAC HSD Criteria and Standardized Review Criteria, Centers for Medicare and Medicaid Services – August 2008

- Pederson-Green S, Repasky C. Medicare Advantage Star Ratings May Decline with New Methodology, McKinsey & Co. September 22, 2022.

- Berwick DM, Hackbarth AD. Eliminating Waste in US Health Care. JAMA. 2012;307(14): 1513-1516. doi:10.1001/jama.2012.362).