(Written in collaboration with Payr Health)

Payers looking to expand into new markets, at a minimum, need to meet regulatory requirements like network adequacy. Network adequacy is a must. Nevertheless, it’s only one piece of a successful network strategy. Ultimately compliance doesn’t guarantee membership or performance. As evidence, consider that in Medicare Advantage, 95% of new county expansions result in fewer than 1,000 new members.¹ To win market share, payers need to think beyond the minimum and thoughtfully construct networks that meet member needs and performance goals.

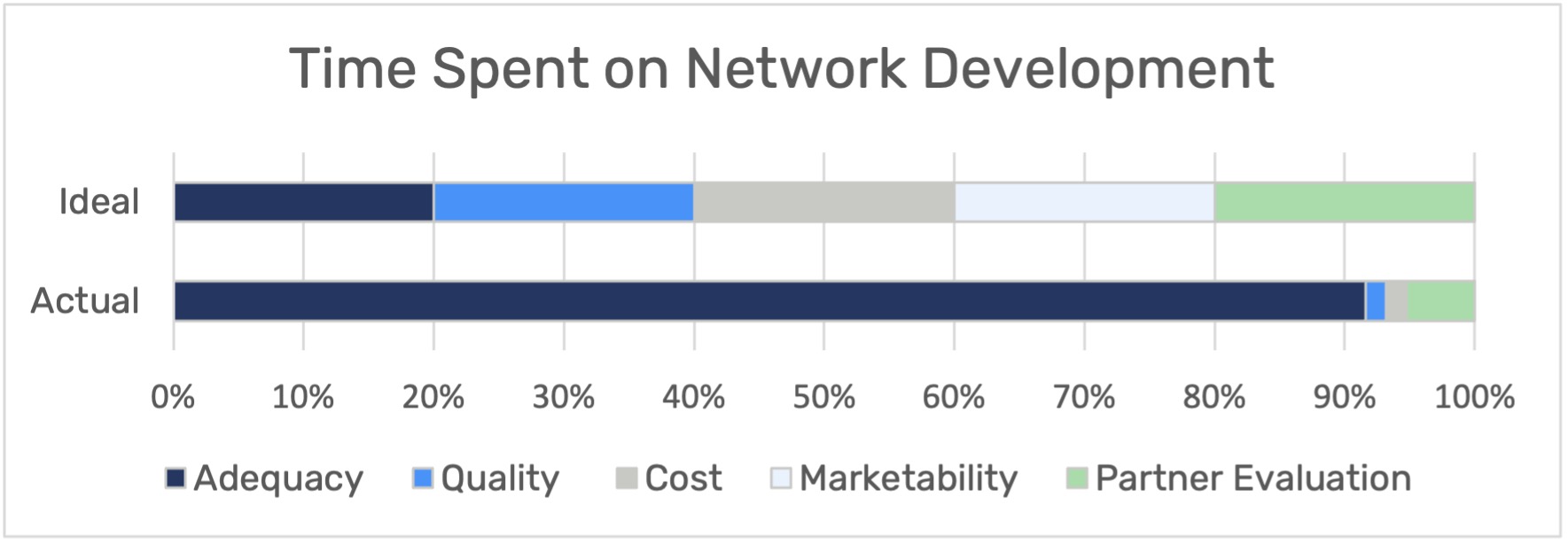

Hitting the minimum bar – reaching network adequacy – is not a straightforward task. We’ve often seen plans expanding into new geographies become consumed, dedicating 80-90% of their network development efforts on compliance and little effort on other critical network factors.²

Developing a network that isn’t marketable may create an unfavorable reputation to prospective members and brokers. Creating a high cost network may unfavorably impact premiums, and benefit design in future years. Undoing network development mistakes made by new entrants can take significant time and capital investment. To avoid spending future years trying to correct past mistakes, payers expanding to new geographies should weigh the following key critical factors in their network development strategy:

- Cost and Quality Performance

- Anchor Partner Strengths

- Local Marketability

Combining these factors successfully, plans can launch with high-performing networks that are attractive to members and financially sustainable for payers.

Cost and Quality Scores

Choosing providers based on their cost (how well a provider is utilizes healthcare resources) and quality effectiveness (how satisfied members are with a provider’s medical care) can substantially impact the bottom line. Including providers who’ve demonstrated high cost and low quality care can lead to higher financial burden and unsatisfactory outcomes for all stakeholders. Contracting proven providers with low cost and high quality care, conversely will decrease the cost of care and drive higher member satisfaction.

Typically, payers assign performance scores after having experience interacting with their providers. New entrants, lacking historical claims data, find themselves at a disadvantage in identifying the high performing providers in the geography. However, plans can get ahead of this with the right data and resources.

For easy proxies on provider performance, payers can find publicly available data in CMS Advanced Payment Programs or identify reputable, risk bearing provider groups (e.g., ChenMed, Oakstreet, Privia). Incumbent payers, such as United, Humana and Blue Cross Blue Shield, may also publish provider performance ratings on their public facing directories.

For a more robust view of performance, payers can partner with provider performance aggregation vendors that specialize in provider performance analysis, using national Medicare, Medicaid & commercial claims datasets. Incorporating these metrics into network strategy helps payers prioritize which doctors will meet network adequacy without sacrificing cost or quality for members.

Anchor Partner Strengths

When entering a new market, it makes a lot of sense to build a network around an anchor health system. In addition to reducing the number of contracts needed, partnerships with established health systems can shed light on provider performance metrics and provide some of the market clout new plans seek.

But the choice of partner should be vetted heavily as a partnership can make or break a new plan’s success. Targeting a large health system with a sizable footprint should not be the only consideration when choosing an anchor partner. Also examine local dynamics. How established is this partner? Does their reputation align with the type of network the payer wants to build? Does contracting with that anchor partner preclude adding important competing providers to the network? How does that impact network build overall? Taking time to look at the big picture before committing to an anchor partner can set payers up for success for years to come as they grow.

Local Marketability

To win market share, health plans need to sell products and networks that members want to buy. Just building your network to meet regulations may lead you to overlook the specific needs of target populations. For example, new plans often neglect the importance of including doctors that speak specific languages or have strong ties to specific local communities that attract new members.

Looking at the networks of existing competitors is a good place to start. From there the basic tenets of popular network construction will be clearer. Are broad or narrow networks more prevalent? Which type of plan is most common? Are certain health systems included in every plan? Those networks will be available through public annual filings and provider directory listings but will still not give new plans all the insights necessary to glean exactly what member populations want.

Experienced consulting firms, like PayrHealth, can be especially valuable in providing strategic planning and resources with focus on the local context. Consultants can also prioritize contracting efforts to make network build more efficient with strategies, such as analyzing membership trends and local payer behaviors.

Final Thoughts

Expanding payers can position themselves for success by investing the effort in all the factors that contribute to high performing networks. Evaluating providers on their cost and quality history, potential anchor systems for brand reputation and local dynamics, and local membership needs, all support payer’s ability to win market share.

Notwithstanding, network adequacy cannot be ignored. Understanding the impact hospital systems and provider partner groups have on adequacy, finding additional providers that potentially close gaps, and then successfully contracting them is time consuming and iterative.

Payers need a network analytics solution that streamlines their pathway to adequacy. J2 Health is that solution. Making time consuming manual processes– like Googling to find providers- previously used to close gaps obsolete, J2 solves adequacy problems using measurements that area 99.9% match to CMS. With adequacy made easy, payers can spend less time on adequacy and more on the other factors that will drive their success.

¹ CMS Landscape Files & Enrollment Data 2018 – 2022, Year 1 Enrollment of New Entrants

² J2 Health Customer Survey

—

About Payr Health

Having negotiated over 50,000 contracts in all 50 states, PayrHealth has the knowledge and expertise to secure highly competitive rates and terms for your contracts, no matter how outdated they are or how big a player the payor is.

About J2 Health

J2 Health provides the technology for healthcare organizations to build their best provider networks and deliver higher value healthcare. Our network adequacy solution provides customers a clear and trusted path to compliance.